[January 22, 2025] LNG Market Analysis Daily

LNG Market Analysis Daily (1.22)

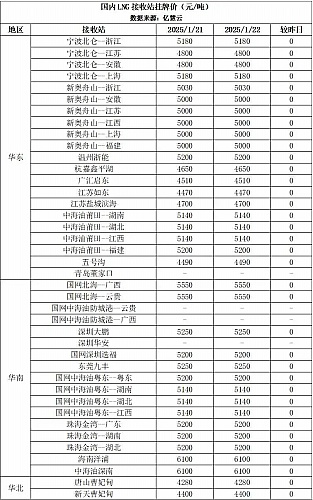

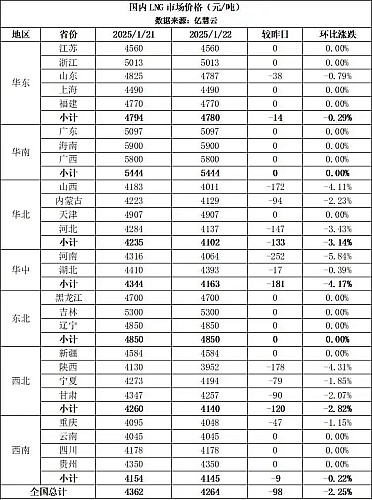

On January 22, the national LNG market prices fell. In terms of domestic gas, due to the large-scale heavy snowfall weather, transportation and liquid plant shipments will be blocked, while downstream demand is depressed, the upstream discharge is eager, coupled with a new round of raw gas auction transaction prices continue to fall, downstream bearish futures, liquid plants in order to promote sales, ensure inventory control, led by the main producing areas, prices concentrated sharply down. Local plunge 400 yuan/ton, the lowest has dropped to 3600 yuan/ton. In terms of imported gas, affected by the price reduction of domestic gas, the volume of receiving station tanks continues to decrease, but the liquid price is still stable, and wait and see the future market trend.

Future market forecast:

It is expected that the national LNG market price will continue to fall on January 23, and the adjustment range will be 20-300 yuan/ton. In terms of domestic gas, in the first half of February, the western raw gas surplus auction, and finally 2.4 yuan/square all transactions, down 0.04-0.06 yuan/square compared with the second half of January, liquid plant costs fell, and 46.1 million square, superposition many liquid prices fell sharply, the market bearish sentiment is high, while taking into account the serious reduction in downstream demand, Coupled with a new round of cold wave snowfall weather, the upstream is mainly to reduce the price of storage, it is expected that the price of domestic gas will continue to decline on the 23rd, some low prices will slow down, and high prices will continue to fall sharply. In terms of imported gas, affected by the collapse of surrounding domestic gas, the price difference between sea and land has further expanded, and the receiving station has a serious disadvantage in high-price shipment. The recent loading volume has significantly reduced, and the radiation range of resources is limited. However, the upcoming cold wave may slightly boost the upstream gas shipments. It is expected that the price of 23 days in the breath is stable and volatile.

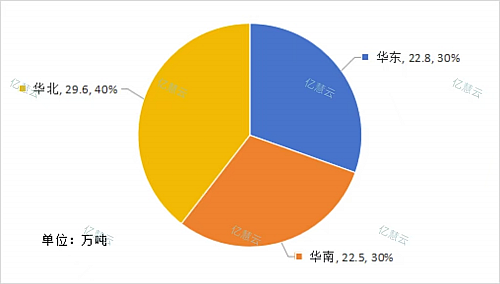

I. National LNG supply

1.1 Factory output

On January 22, of the 255 LNG plants in the country, 57 were repaired, halted, and stopped reporting, with an overall operating rate of 77.6%.

2.1. International Gas Price Index

On January 22, due to the impact of domestic gas price reduction, the receiving station tank batch continued to decrease, but the liquid price was still stable and mainly watched the future market trend.

January 22, due to the large-scale heavy snow weather will usher in the country, logistics transportation and liquid plant shipments will be blocked, while downstream demand is depressed, the upstream discharge is eager, coupled with a new round of raw gas auction transaction prices continue to fall, the market bearish, in order to promote sales, ensure inventory control, led by the main producing region, liquid prices concentrated sharply down, Prices in many places have dropped to less than 4,000 yuan/ton; Surrounding southwest and Shandong and other places, by the impact of the price reduction atmosphere, superimposed weak terminal demand, liquid prices fell steadily.

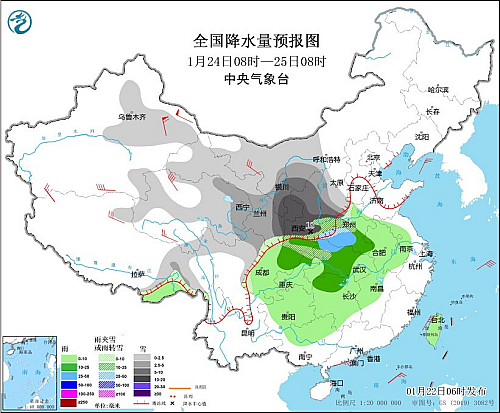

3.1 Weather and Traffic

From January 23 to 24, there was light to moderate snow or sleet in most of northern Xinjiang and high-altitude mountainous areas in southern Xinjiang, western and southeastern Tibet, southern Qinghai, eastern Gansu, southern Ningxia, central and northern Shaanxi, southern Shanxi and western mountainous areas of Henan, among which there was heavy snow in some areas along the northern Tianshan Mountains in Xinjiang and southwest Tibet. Some parts of southern Shaanxi, central and eastern Sichuan, Chongqing, central and eastern Guizhou, central and western Hubei, western Hunan, Henan, northwest Anhui, southwest Shandong, Taiwan Island and other places have moderate rain. From January 24 to 25, there was light to moderate snow or sleet in eastern Xinjiang, western Inner Mongolia, most of Qinghai, most of Gansu, northern western Sichuan Plateau, Ningxia, Shaanxi, western and south-central Shanxi, western Henan, western Hubei and other mountainous areas, among which, Eastern Gansu, most of Ningxia, Inner Mongolia Hetao area, central and northern Shaanxi, southern Shanxi, western Henan and other parts of the heavy snow. Central and eastern Sichuan, Chongqing, most of Guizhou, most of Hunan, Hubei, central and southern Henan, Anhui, western Jiangsu, northwest Jiangxi, northern Guangxi, Taiwan Island and other parts of the light to moderate rain, among them, southern and western Henan, western Hubei and other parts of the heavy rain.

3.2.1 Domestic Hot Spots

In 2024, the annual output of shale oil in Fuxing Block of Fuling Shale Gas field in Jianghan Oilfield exceeded 30,000 tons, an increase of nearly 100% over the previous year, showing a strong momentum of production.

3.2.2 International Hotspot

U.S. President Donald Trump has lifted a ban on new LNG export licenses in the United States, easing a prolonged period of uncertainty over global gas supplies and triggering volatility in European gas prices. According to a report by the International Energy Agency, European LNG imports are expected to grow by more than 15% this year due to reduced Russian pipeline gas supplies and increased demand.

International Energy Agency: Global gas demand grows by 2.8% to a record 4.21 trillion cubic meters in 2024 According to the International Energy Agency's Quarterly Gas Market report, global gas demand grew by 2.8% to a record 4.21 trillion cubic meters in 2024, while growth is expected to be more modest at 2% in 2025. That's 4.29 trillion cubic meters.

Qingdao Sino Energy Tech Co.,Ltd

Qingdao Sino Energy Tech Co.,Ltd